Delphi Ventures Implements Integral for Accounting and Operations

Delphi Ventures transformed their operations, scaled trust, and harnessed the full potential of blockchain through a seamless integration with Integral's cutting-edge accounting and operational solutions.

Products used

Challenge - Manual Processes Create Risk

All organizations that interface with digital assets face significant operational problems caused by the lack of comprehensive infrastructure for accounting and operations. These business-critical functions are by default relegated to manual, labor-intensive processes, leading to inefficiency, risks, and requisite trust in humans.

Recognizing the importance of this function early-on in a complex space, Delphi Ventures hired best-in-class digital asset-focused firms to execute its accounting function. In doing so, Delphi Ventures learned, as have many other institutional and commercial operators in the crypto space, that even specialized (expensive) accounting firms require significant context and handholding from the client, and work product is oftentimes a black box in Excel. In many cases, the accountants do not understand how to read in order to manually pull (read: cut and paste) the raw transaction data from the blockchain. In particular, this status quo before Integral, intensely manual and gives rise to the following problems and risks:

Extreme Efficiency and Operational Drag

The default process for accounting for a blockchain transaction is dictated by the trusted accountant processing the transaction, and generally follows the process below:

Operator downloads block explorer .csv

Email the file to the accountant when they ask for it, generally several months in arrears

Operator searches in email/telegram/slack to contextualize each transaction

Accountant books half of the transactions via legacy accounting software

Accountant asks additional questions on remaining transactions

Operator searches in email/telegram/slack to contextualize the remaining questions

Accountant books half of the transactions via legacy accounting software

For operators like Delphi Ventures who operate in both fiat and digital assets, the population of source data extends far beyond etherscan, was a library of internally maintained spreadsheets, blockchain explorers, protocol front ends, .csv files, and monthly statements. Without supporting technology, accounting for this disparate data is intensely manual and expensive to process by accountants.

Representation of Delphi Ventures Operational Stack before Integral

Increased Risk of Fraud and Error

Given the manual nature of and complexity of the process described above, even with internal controls and oversight, opportunities exist for bad actors to do bad things (ie. embezzling funds and annotating a proper business purpose). Centralized manual processes that rely on human intervention are susceptible to error. Human data entry, copy-pasting, and spreadsheet management heighten the risk of inaccuracies, potentially undermining trust in financial data integrity for Delphi Venture’s investors, auditors, employees, and other stakeholders.

Key Man Risk

In a trustful operation, organizations face substantial key man risk. Manual digital accounting operations rely heavily on specific knowledge groups and individuals, who often are in a position to exploit their position of trust. When operating an entity at the scale of Delphi Ventures, it gives rise to material concentrated key man risk to the business.

Accounting as a Silo’d Cost Center and isn’t Real-time

Traditional accounting functions are a cost center, and at their worst, drain resources without offering strategic value to the business. When financial statements are [a year] late, accounting provides zero value to (a) decision-making (b) risk management (c) treasury management and (d) tax planning for business leaders.

Delphi Ventures understood that a comprehensive solution could transform their accounting and operations into a value driver, adding strategic benefits beyond mere bookkeeping.

In Search of a Solution

Delphi Ventures learned quickly that accountants (including those that leverage homegrown technology) are not sufficient to meet basic needs. Delphi Ventures looked to the market to implement a fit-for-purpose solution.

In conducting market research, Delphi Ventures evaluated the available offerings in the market and concluded the following:

Asset Completeness is a Blocker: Asset completeness is not available or, in terms of Delphi Ventures’ operational needs, even at a usable state from a single provider on the market.

Feature Completeness is a Block when the Product Roadmap Stops with Accounting: Even with a path to complete asset coverage, Delphi Ventures found many of the competitive platforms to be limited to one of the following domains: accounting, tax, or finance. A solution that comprehensively provides actionable insight across these domains generates greater (a) utility and (b) return on spend/time resources to Delphi Ventures.

In sum, Delphi Ventures sought out a solution that addressed both problem statements to make one technology selection and make it right, and address the totality of their problem statements over a long-term time horizon. They found this solution with Integral.

Solution - Delivering Business Outcomes at Venture Scale

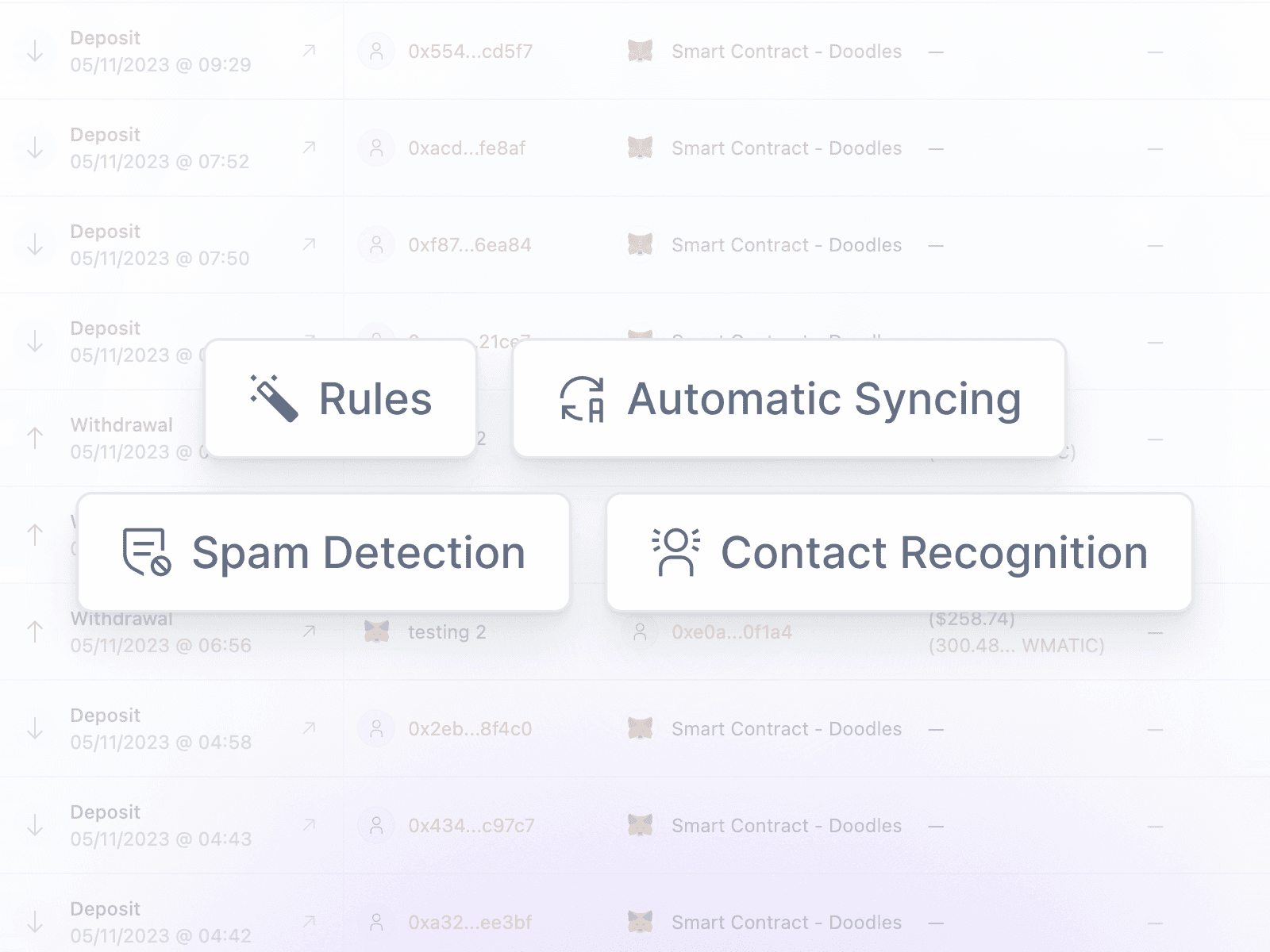

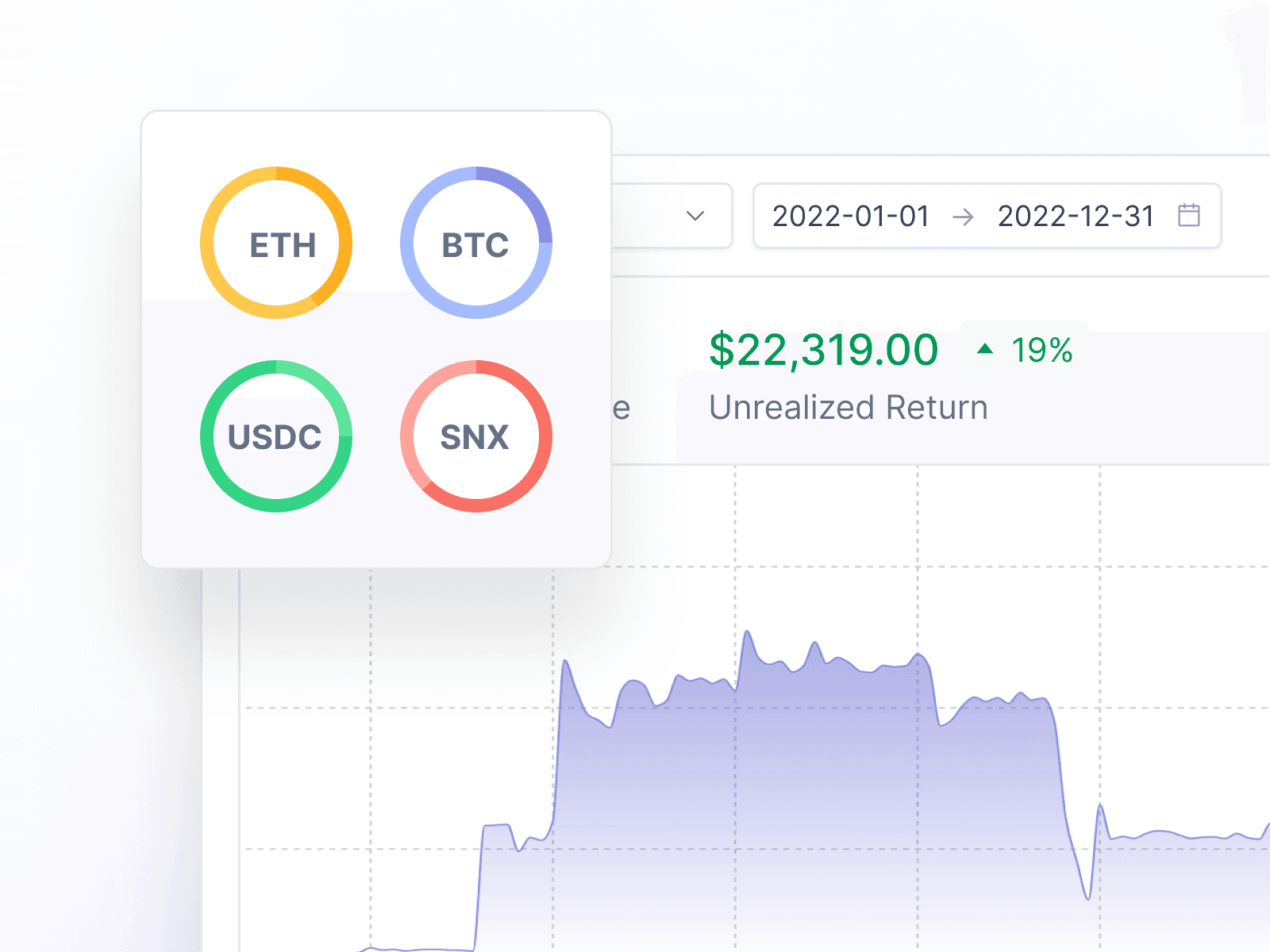

After learning of (a) Integral’s ability to aggregate, track, and provide real-time insights into digital assets across various chains and (b) the long-term product vision inclusive of accounting/tax/finance functionality, Delphi Ventures implemented Integral technology across the entirety of its business. The following outcomes have been achieved at scale:

Asset Support

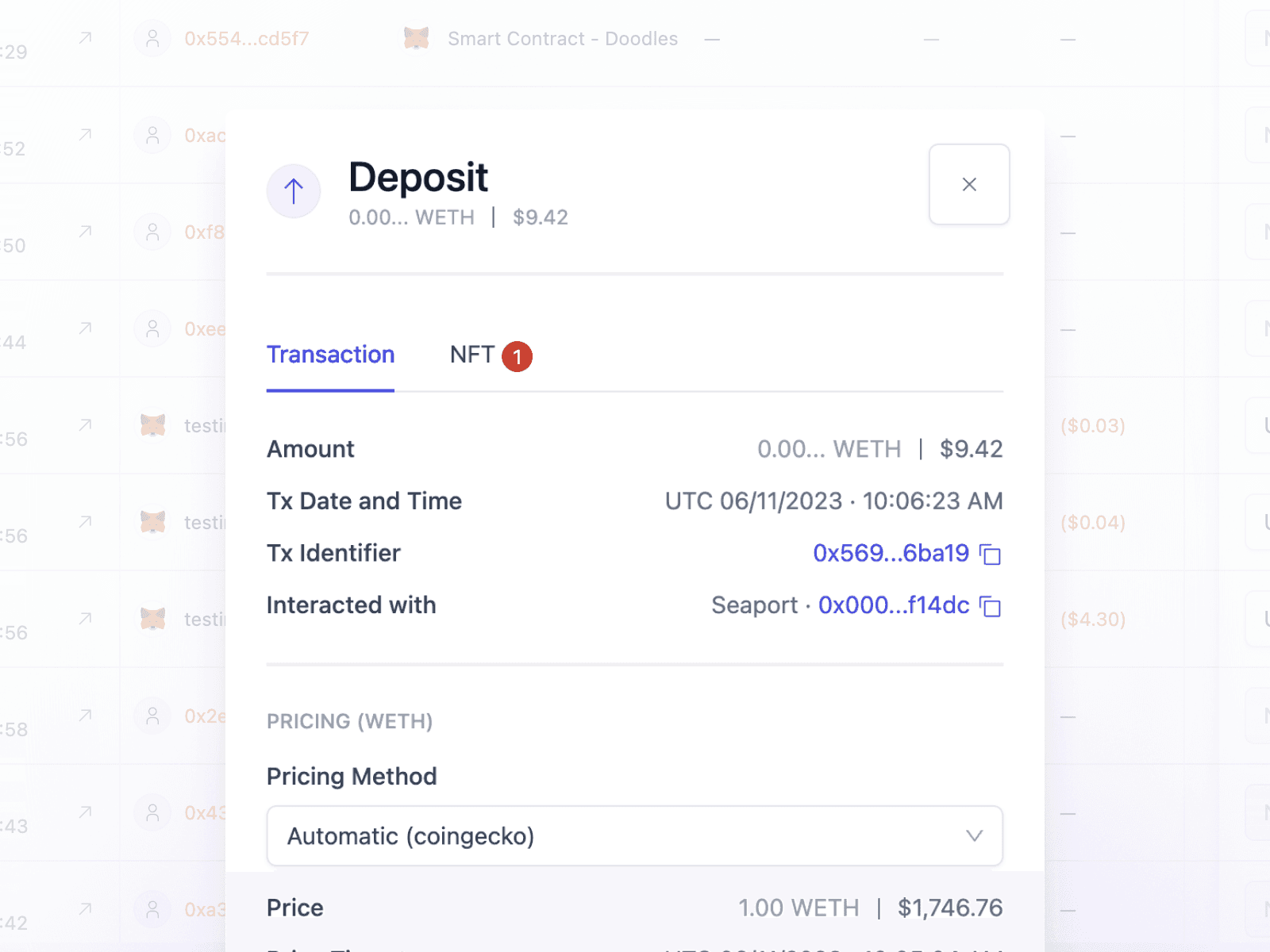

Completeness is a baseline expectation for any asset manager’s accounting operation. Delphi Ventures’ portfolio demands a technology solution that provides completeness across its assets. Delphi Ventures has unique requirements such as capturing illiquid investments like SAFEs, transactions on various L1s and L2s, Thorchain’s streaming swaps, token unlocks, and NFTs on various chains.

A Small Sample of Integral Supported Accounts

NFT Accounting via Integral (demo account)

Data Hardness and Quality

As crypto-native investors, Delphi Ventures has zero tolerance for missing or incorrect values sourced from blockchain data. Integral provides both an user-facing data validation module as well as a data team service that can conduct rigorous quality control for the most complicated cases. Integral’s platform has supported Delphi Ventures in passing its funds’ financial statement audits. Further, by removing trustful processes and simply relying on the blockchain as the source of truth, the human and centralization risks in the accounting process are mitigated.

This has always been the promise of triple entry accounting and is now implemented by Delphi Ventures via Integral.

Integral’s Usability Bridges the Knowledge Gap

A requirement of Delphi Ventures upon was for the technology to generate outputs that non-crypto native individuals (including accountants) can easily understand. In the infancy of a tokenized world, third party consumers of complex digital asset transactions (including core service providers such as accountants, auditors, etc.) frequently struggle to grasp the nuances of web3 transactions. Integral’s solution that normalizes contextualized blockchain inputs is the solution that bridges the web3 knowledge gap.

Institutional-Grade Feature Set

Delphi Ventures operates its business with complexity across accounting and operational functions including: token unlocks, illiquid non-token-based investments, and transactions across multiple entities in the organization.

Token Unlocks Captured in Integral (demo account)

Integral's multi-entity feature

Results

35% Reduction in Accounting Costs, 1 FTE's Time Freed Up

Time saved in reconciliation: Delphi Ventures estimates accounting costs have been reduced by 35% and 1 FTE has been saved by implementing Integral. By dedicating fewer resources to manual reconciliation, Delphi allows their team to focus on higher-value strategic tasks for their portfolio companies. Delphi Ventures expects these outcomes to be cumulative and material to its investors over time.

Effectiveness as a ledger: Delphi now has a single, reliable source of truth that fosters efficient and error-free communication. The quantity of hours saved using a single source-of-truth is material and unmeasured. What sets Integral apart is its capability to provide outputs that non-crypto-native service providers, including tax accountants, bookkeepers, accountants, advisors, and auditors, can seamlessly understand and work with to validate data.

Near Real-time Transaction Reconciliation

Delphi Ventures' instance of Integral allows them to complete transaction reconciliation near real-time. When accounting inputs are available at the operator’s fingertips and simultaneously usable by end-to-end stakeholders — the accounting records themselves become immediately actionable to the business.

The future

Delphi Ventures views its implementation of Integral not simply as a crypto subledger upgrade; rather as comprehensive solution that will scale beyond the accounting department. Integral plans to take a role in tax planning, support FP&A, wrap execution, and deliver actionable business intelligence.

Delphi Ventures supports founding teams in building blockchain technology – a fundamentally new way for humans to coordinate at scale, removing intermediaries. Shifting from human-based accountants to Integral’s code reduces risk, eliminates centralized intermediaries, and improves efficiency. Delphi Ventures is proud to be a customer of Integral and support their mission to create a better, trustless financial system, starting with enabling businesses to use crypto technologies.